Markets in a Minute: Vegas, Baby: Investing vs. Gambling

Ever heard someone proclaim, “investing in the stock market is just like gambling in Vegas”? Last week, as I sat in a hotel lobby on the Las Vegas Strip a few hours before speaking at an investment conference, I was struck by just how inaccurate that statement is. I hate gambling and love investing.

It may seem particularly ironic that I would feel that way, surrounded by the flashing lights and swish of coins pouring out of the slot machines, while stocks are nine months into a bear market. It comes down to this: I’m happy to take risks and sustain losses as long as I can be reasonably sure that, over time, I’ll make money. And Las Vegas, for all its glitz, just can’t offer me those odds.

Odds Over Time

In contrast, the longer you invest, the more likely you are to grow your money and build wealth. Over the last 100 years, investors who invested in the U.S. stock market have experienced average returns of around 10%. Now in the short-term, you may experience a down month, quarter, or even a bad year like 2008, but the stock market has consistently rebounded and continued to provide positive returns over the long haul.

Separating Winners and Losers

- Avoid short-term strategies such as market timing or performance chasing

- Remain disciplined and don’t react to temporary market shifts

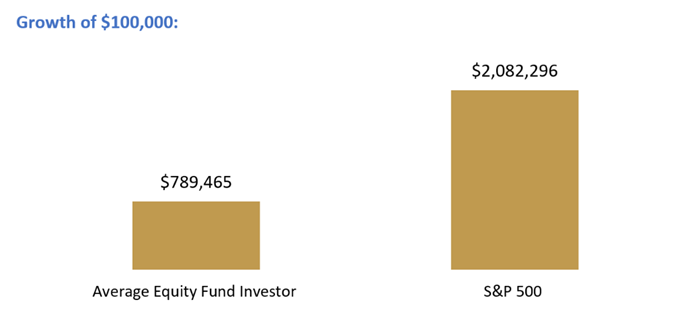

The Dalbar Study: 30 Years of Average Equity Fund Investor vs. S&P 500

How to Pursue a Winning Strategy

At the casino, Blackjack gives you the best odds to beat the house at 49%. But that’s still a losing prospect over the long-term.

Focusing on long-term gains is the key to stacking your odds of success in the stock market. Since 1945 the S&P 500 has delivered an impressive average rate of return of 11%. During that time, the index was up 79% of the time during all 1-year periods. That winning percentage increases to 90% during all 5-year periods and 97% for all 10-year periods. Buying the S&P 500 turned a profit 100% of the time for all 20-year and 30-year periods.

S&P 500 Probability of Positive Returns

12/31/1945 to 12/31/2021

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Note: views are from a U.S. dollar perspective. Source: Kestra Investment Management with data from FactSet. Index proxies: S&P 500. Data as of December 31, 2021

While the market offers much more attractive odds than Las Vegas, it is critical that investors stay the course, or those odds decline dramatically. In fact, because most investors sell when stocks are low, and buy when they’re high, they tend to earn less than half of what they could if they simply stayed the course.

Improve your odds by investing strategically for the long term, and chances are that you’ll make a lot more than you’ll lose.

Don’t gamble. Invest wisely and live richly,

Kara

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. Does not offer tax or legal advice.